Do you want more income with

less tax?

Would you like to switch or

rebalance investments without

triggering capital gains or losses?

Does a flexible, customized

level of income appeal to you?

If so, keep reading.

Income investors and retirees face a difficult environment. Not only do traditionalincome-producing investments offer lowyields, but they are subject to a heavy taxburden.

We have a tax-efficient cash flow solution for you;

T-CLASS

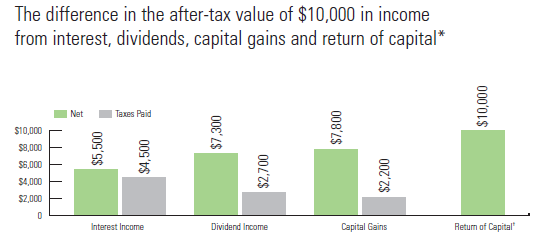

For a sustainable and tax-efficient cash flow,invest in T-Class from CI Investments. T-Classtakes advantage of the fact that different typesof income carry different tax rates. Interest (andemployment) income is taxed at the highestrate, while dividend income and capital gainsare taxed at lower rates. (See chart.)Payments in the form of return of capital(ROC) ,however, are not taxable. That’sbecause it represents unrealized gainsin your investment or the return of youroriginal capital

T-Class funds are built on CI’s Corporate Class structure, which allows for monthly payments that are 100<>percentage<> non-taxable return of capital . That means your after-tax cash flow will be significantly higher than with other forms of income.

T-Class provides regular monthly paymentswhile minimizing the pain of taxation. Andwith a choice of over 50 funds, representinga broad range of equity, income, balancedand portfolio funds, you can still benefitfrom the potential for growth in yourinvestments.

THE T-CLASS ADVANTAGE The difference in the after-tax value of $10,000 in income from interest, dividends, capitals gains and return of capital*

* Assumes a tax rate of 45<>percentage<> on interest income, 27<>percentage<> on Canadian dividend income and 22<>percentage<> on capital gains.Tax rates based on an average of the highest combined federal and provincial personal income tax rates in 2014. Return of capitaldistributions reduce the adjusted cost base or ACB of your investment. Over time, the ACB may fall to zero, in which case the monthlypayments from T-Class will be treated as capital gains – which are still taxed at more favourable rates than dividends or interest income. Pleasenote that T-Class shares may also pay a taxable annual dividend. This communication is published as a general source of information and is notintended to provide personal legal, accounting, investment or tax advice. Before acting on any of the information contained herein, please seekprofessional advice based on your personal circumstances. Commissions, trailing commissions, management fees and expenses all may beassociated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values changefrequently and past performance may not be repeated. Paid for in part by CI Investments. ®CI Investments and the CI Investments design areregistered trademarks of CI Investments Inc.

Mr. Salvatore Mulé & Mrs. Karine Labelle have been providing investmentadvice to their clients since 1999. They have a combined 30 years ofexperience and are both under 40. Because of their passion and expertise,they are well respected among their peers and their clients. They have givennumerous seminars and are often asked for their professional opinion oninvestment planning for financial magazines.

In The Latest Issue:Latest Issue:

In The Latest Issue:Latest Issue:

- A Bittersweet Farewell

- The new Laval Aquatic Co...

- The End of an Era:

Articles

Calendar

Virtual- ANNUAL TEACHER APPRECIATION CONTEST

- APPUI LAVAL

- ARTS & CULTURE

- CAMPS

- CAR GUIDE

- CCIL

- CENTENNIAL ACADEMY

- CHARITY FUNDRAISING

- CITYTV

- COSMODÔME

- COMMUNITY CONNECTIONS

- COVER STORY

- DINA DIMITRATOS

- ÉCOLE SUPÉRIEURE DE BALLET DU QUÉBEC

- EDITORIALS

- ÉDUCALOI

- EDUCATION

- EMPLOYMENT & ENTREPRENEURSHIP

- FÊTE DE LA FAMILLE

- FÊTE DU QUARTIER SAINT-BRUNO

- FAMILIES

- FESTIVAL LAVAL LAUGHS

- FÊTE DE QUARTIER VAL-DES-BRISES

- FINANCES

- GLI CUMBARE

- GROUPE RENO-EXPERT

- HEALTH & WELL-BEING

- 30 MINUTE HIT

- ANXIETY

- CHILDREN`S HEALTH & WELLNESS

- CLOSE AID

- DENTAL WELLNESS

- EXTREME EVOLUTION SPORTS CENTRE

- FONDATION CITÉ DE LA SANTÉ

- GENERAL

- HEARING HEALTH

- MESSAGES FROM THE HEALTH AGENCY OF CANADA

- MENTAL HEALTH

- SEXUALITY

- SOCIAL INTEGRATION

- SPECIAL NEEDS

- TEENS

- THE NUTRITION CORNER

- THE NUTRITION CORNER - RECIPES

- VACATION DESTINATION

- WOMEN'S FITNESS

- WOMEN'S HEALTH

- HILTON MONTREAL/LAVAL

- HOME & GARDEN

- INTERNATIONAL WOMEN'S DAY

- JAGUAR LAVAL

- LAVAL À VÉLO

- LAVAL FAMILIES TV SHOW

- LAVAL FAMILIES MAGAZINE CARES

- LAVAL URBAN IN NATURE

- LE PARCOURS DES HÉROS

- LES PETITS GOURMETS DANS MA COUR

- LEON'S FURNITURE

- LEONARDO DA VINCI CENTRE

- LFM PREMIERES

- LIFE BALANCE

- M.P. PROFILE

- MISS EDGAR'S AND MISS CRAMP'S SCHOOL

- MISSING CHILDREN'S NETWORK

- NETFOLIE

- NORTH STAR ACADEMY LAVAL

- OUTFRONT MEDIA

- PASSION SOCCER

- PARC DE LA RIVIÈRE-DES-MILLE-ÎLES

- PÂTISSERIE ST-MARTIN

- PIZZERIA LÌOLÀ

- PLACE BELL

- PORTRAITS OF YOUR MNA'S

- ROCKET DE LAVAL

- SACRED HEART SCHOOL

- SCOTIA BANK

- SHERATON LAVAL HOTEL

- SOCIÉTÉ ALZHEIMER LAVAL

- STATION 55

- STL

- SUBARU DE LAVAL

- TECHNOLOGY

- TEDXLAVAL

- TODAY`S LAURENTIANS AND LANAUDIÈRE

- TODAY`S LAVAL

- WARNER MUSIC

- THIS ISSUE

- MOST RECENT

Magazine

Tax-Efficient Cash Flow

Articles ~e 105,7 Rythme FM 4 chemins Annual Teacher Appreciation Contest Appui Laval Arts & Culture Ballet Eddy Toussaint Camps THIS ISSUE MORE...

CONTESTS Enter our contests

CONTESTS Enter our contests

CALENDAR

Events & Activities

COMMUNITY Posts Events

PUBLICATIONS Our Magazine Family Resource Directory

LFM BUSINESS NETWORK Learn more

COUPONS Click to save!

COMMUNITY Posts Events

PUBLICATIONS Our Magazine Family Resource Directory

LFM BUSINESS NETWORK Learn more

COUPONS Click to save!

SUBSCRIPTIONS

Subscribe to the magazine

Un-Subscribe

E-NEWSLETTER Subscribe to our E-newsletter Un-Subscribe

WRITE FOR US Guidelines & Submissions

POLLS Vote today!

E-NEWSLETTER Subscribe to our E-newsletter Un-Subscribe

WRITE FOR US Guidelines & Submissions

POLLS Vote today!

ADVERTISERS

How to & Media guide

Pay your LFM invoice

SUGGESTIONS Reader's Survey Suggest a Listing

LFM About Us Our Mission Giving Back Contact Us

SUGGESTIONS Reader's Survey Suggest a Listing

LFM About Us Our Mission Giving Back Contact Us

PICK-UP LOCATIONS

Get a copy of LFM!

PICK-UP LOCATIONS

Get a copy of LFM!

TERMS & CONDITIONS Privacy | Terms

ISSN (ONLINE) 2291-1677

ISSN (PRINT) 2291-1677

Website by ZENxDESIGN

BY:

BY:

Tweet

Share